Tax Professionals' Guide to relocating to Paris

Background

Paris is the third most visited city in the world with 70 million tourists visiting the city each year. According to the OECD, France the number 1 city in Europe and second in the world for quality of living.

Employers

Paris is known as the financial centre of France. All of the Big 4 have a presence and offices in the capital. The industry in Paris has several key strengths: 3 of Europe’s 5 biggest investment banks are situated in the Paris Region, it provides more than 1 million jobs and the city has a well proven track record as being a driver of innovation.

The French Government believes that Paris may overtake London’s financial industry in 5-10 years due to Brexit consequences. France would like Paris to become the new financial hub for Europe, and to attract more financial companies they intend to build seven new skyscrapers by 2021, in order to “accommodate new talent. In 2017 President Macron has proposed cutting corporation tax to incentivise multi-nationals and simplified the process of registering new financial companies in France.

To view current tax jobs in Paris please follow this link:

https://www.etaxjobs.com/browse-jobs/europe-middle-east-and-africa-tax-jobs/paris-tax-jobs/

Working in Paris

In an increasingly connected world, determined to remain at the cutting edge, France has embraced digital trends and innovations, including connected cars, driverless cars, eHealth and smart homes are all prevalent in the country.

The French language is also an important element of the country’s culture. Over 220 million people speak French worldwide and it is a popular language to learn. You can sign up to private tutors in the city for between €12 and €20 per hour. Alternatively, there are a number of language schools across Paris such as Alliance Francaise who offer a number of different French courses about living and working in France. However, if languages aren’t your thing then the majority of residents in Paris can speak English.

Taxation

The information below is sourced from PwC:

http://taxsummaries.pwc.com/ID/France-Individual-Taxes-on-personal-income

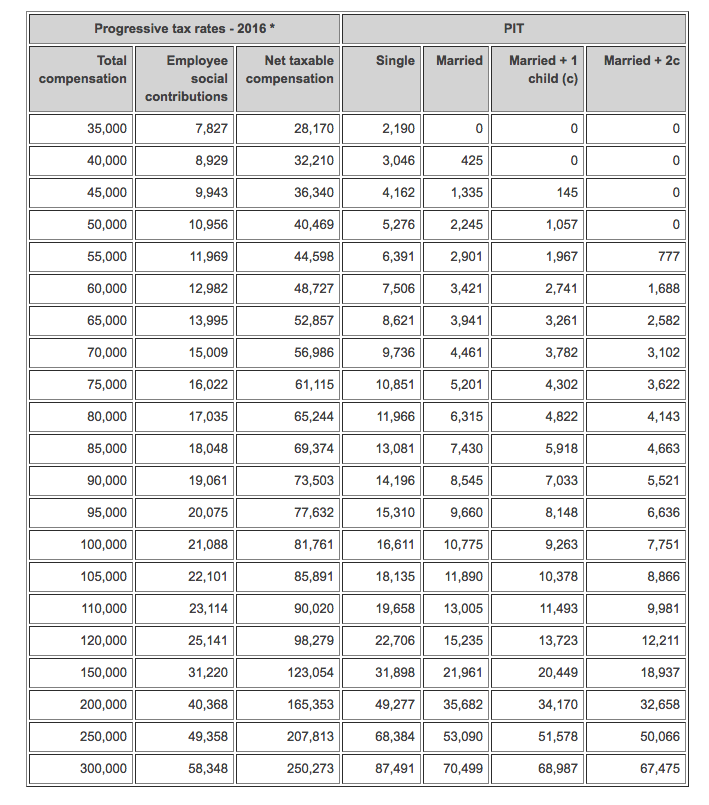

Individuals, whether French or foreign nationals, who have their tax domicile in France are generally subject to personal income tax (PIT) on worldwide income unless excluded by a tax treaty. Individuals who are not domiciled in France (non-residents) are subject to tax only on their income arising in France or, in certain cases, on imputed income.

Rates are progressive from 0% to 45%, plus a surtax of 3% on the portion of income that exceeds EUR 250,000 for a single person and EUR 500,000 for a married couple and of 4% for income that exceeds EUR 500,000 for a single person and EUR 1 million for a married couple.

Transport

Public transportation is the easiest way to travel in Paris. With a travel pass you get unlimited access to all transportation networks across Paris and the Île-de-France region for one month from €65. A lot of Parisians will also walk from place to place. The city is very pedestrian friendly and it is an easy way to get to know your new home whilst getting some exercise!

Health

All residents in France are required to have some form of health insurance. It is now possible that after three months of residence, expats can apply to France’s state health insurance which will allow you access to their healthcare system. The system is known as Protection Universelle Maladie (PUMA).

Accommodation

Paris is a very expensive place to live and expats should expect to downsize in the hunt for accommodation. Paris is divided into 20 arrondissements (districts), starting in the middle with number 1 (written as le premier or 1e). Finding an apartment centrally is very competitive but from the middle outwards the districts grow in size and the rent tends to decrease.

For a one-bedroom apartment in the city centre the rent varies from €800-€1,500/month compared to around €600/month outside of the city. May to July is the prime time for property searching in Paris, September through to October being the most difficult, as a lot of properties have already been secured.

Schooling

There are a large number of international schools across the capital and the 16e and 17e are home to two of the most outstanding: The International School of Paris and the Kingsworth International School. General fees for international schools in the city are around €6,000 a year for pre-school and €15,000 for higher grades. This top ten list of bi-lingual schools may be of interest if you would like your child to become fluent in French: http://blog.lodgis.com/en/international-bilingual-schools-paris/

Alternatively, there is a wide range of public schools available across Paris.

This post has been kindly written by tax recruitment specialists, Kingpin International, who publish a series of lifestyle news on living and working in European cities.