Tax Professional's Guide to relocating to Luxembourg

Background

Officially called the Grand Duchy of Luxembourg, Luxembourg is a landlocked country in western Europe. It is bordered by Belgium to the west and north, Germany to the east, and France to the south. Its capital, Luxembourg City, together with Brussels and Strasbourg, is one of the three official capitals of the European Union and the seat of the European Court of Justice, the highest judicial authority in the EU. Its culture, people and languages are highly intertwined with its neighbours, making it essentially a mixture of French and Germanic cultures. This is emphasised by the three official languages, Luxembourgish, French, and German.

With an area of 2,586 square kilometres, it is one of the smallest sovereign states in Europe, about the same size as the US state of Rhode Island or the English county of Northamptonshire. In 2016, Luxembourg had a population of 576,249, which makes it one of the least-populous countries in Europe, but by far the one with the highest population growth rate. Foreigners account for nearly half of Luxembourg's population.

The industrial sector, which was dominated by steel until the 1960s, has since diversified to include chemicals, rubber, and other products. During the past decades, growth in the financial sector has more than compensated for the decline in steel production. Services, especially banking and finance, account for the majority of economic output. Luxembourg is the world's second largest investment fund centre (after the United States), the most important private banking centre in the Eurozone and Europe's leading centre for reinsurance companies. Moreover, the Luxembourg government has aimed to attract Internet start-ups, with Skype and Amazon being two of the many Internet companies that have shifted their regional headquarters to Luxembourg.

Employers

All of the Big 4 have offices in Luxembourg as do many of the medium sized firms like Mazars, BDO and Grant Thornton. Lots of law firms with tax practices have offices in Luxembourg eg Allen & Overy, Arendt, Loyens & Loeff, Baker McKenzie, Clifford Chance and Linklaters are all present. There are also numerous in-house tax teams situated in the country eg Amazon has a large EMEA tax team based in Luxembourg.

There is a highly diverse workforce and within a Big 4 international tax group you will sit alongside tax professionals who hail from many different jurisdictions.

Click on this link to see Luxembourg tax jobs.

Taxation

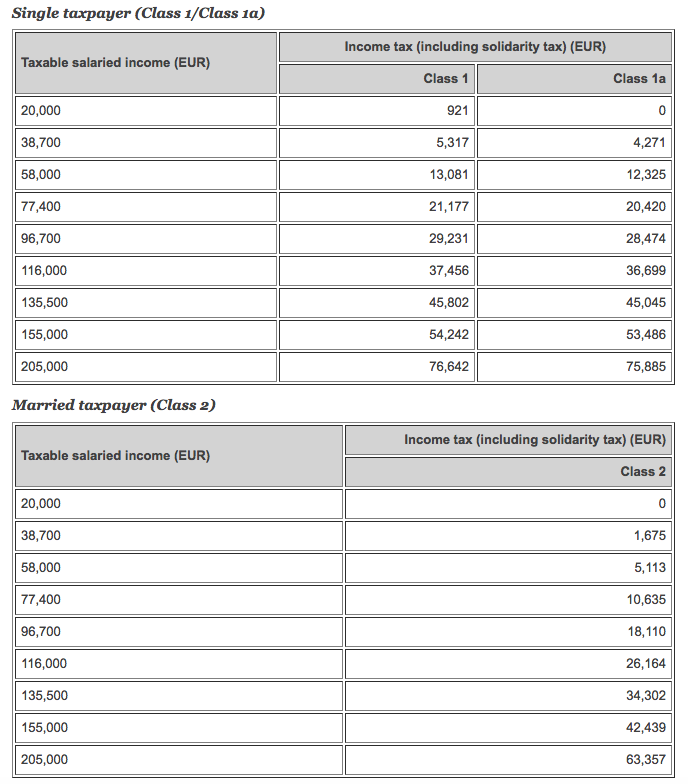

Tax is calculated in accordance with a progressive table, ranging from 8% on taxable income in excess of EUR 11,265 to 42% on income in excess of EUR 200,004 for 2017. A solidarity tax of 7% of taxes (9% for taxpayers earning more than EUR 150,000 in tax class 1 and 1a or more than EUR 300,000 in tax class 2) must also be paid.

Source: PwC http://taxsummaries.pwc.com/ID/Luxembourg-Overview

Transport

Luxembourg has a very good public transport network, both rail and bus and this costs just 34 Euros per month covering the whole country.

Car-pooling for commuters is encouraged within The Grand Duchy, More information on this can be found here http://www.luxembourg.public.lu/en/se-deplacer-au-luxembourg/en-commun/covoiturage/index.html

Because the cost of accommodation is relatively high within Luxembourg, many employees (with family) whose to live in Germany, France or Belgium and then drive or take the train to work. See our accommodation section below for more information.

Health

In Luxembourg, all citizens are covered for free basic healthcare. The taxes used to fund the healthcare system are derived from the pay of employed citizens and employees. These contributions have a cap of EUR 6,625. The employer and employees each pay half of the amount. Foreigners who reside in Luxembourg but who are not employed, such as retirees, need to show evidence of health insurance in order to acquire a residence permit.

The healthcare system in Luxembourg works on the basis of reimbursements. The Caisse de Maladie specifies all types of medical fees and individuals can submit their receipts for doctors’ consultations, treatments and medications and receive reimbursement. While one can receive 100 percent reimbursement for nearly all doctors’ visits, the rates may be different for other medical services. In the case of prescription medicines, the reimbursement is usually around 78 percent. There can be reimbursements for dental treatments, provided the dentist is registered with the Caisse de Maladie. Reimbursements may also be provided for emergency treatment received in a neighboring country.

It is a common practice to obtain supplementary insurance from any of the non-profit health insurance agencies or associations affiliated to Luxembourg’s Ministry of Social Security. Employers also offer supplementary health cover to their employees as an employment benefit. In such cases, individuals can receive the portion of medical fees that is not covered by the state-funded health insurance. Private health insurance also offers coverage for other medical services such as eye care, hospitalization and treatment outside the country. All hospitals in Luxembourg are public hospitals, run by the Caisse de Maladie. There are no private hospitals.

Sport

Unlike in most countries in Europe, Luxembourg does not have a particular national sport. Despite this lack of a central sporting focus, over 100,000 people in Luxembourg, which has a total population of only 460,000, are licensed members of one sports federation or another. Althletics, Cycling, Tennis Cricket, Football and Rugby are the most popular.

Accommodation

You can expect to spend EUR 1400 per month for a 2 bed aparment or EUR 900 for a studio.

The links below will be helpful in your research:

http://www.luxembourg.public.lu/en/vivre/qualite-et-cout-de-vie/cout-de-vie/cher-pas-cher/index.html

Schooling

The majority of schools are free public schools but there are also some fee-paying private schools; they follow the same syllabuses and prepare pupils for the same diplomas.

In addition to the public and private schools, there are some fee-paying foreign schools which offer a different curriculum. These are often popular with expat tax professionals.

Two private schools for expats are:

St George's International School

St George's School fees: http://www.st-georges.lu/uploaded/Admissions/School_Fees_for_the_2017-2018_School_year.pdf

The fees here range from Eur 8,000 a year (at Nursery level) to Euro 15,000 a year (at senior school)

International School of Luxembourg